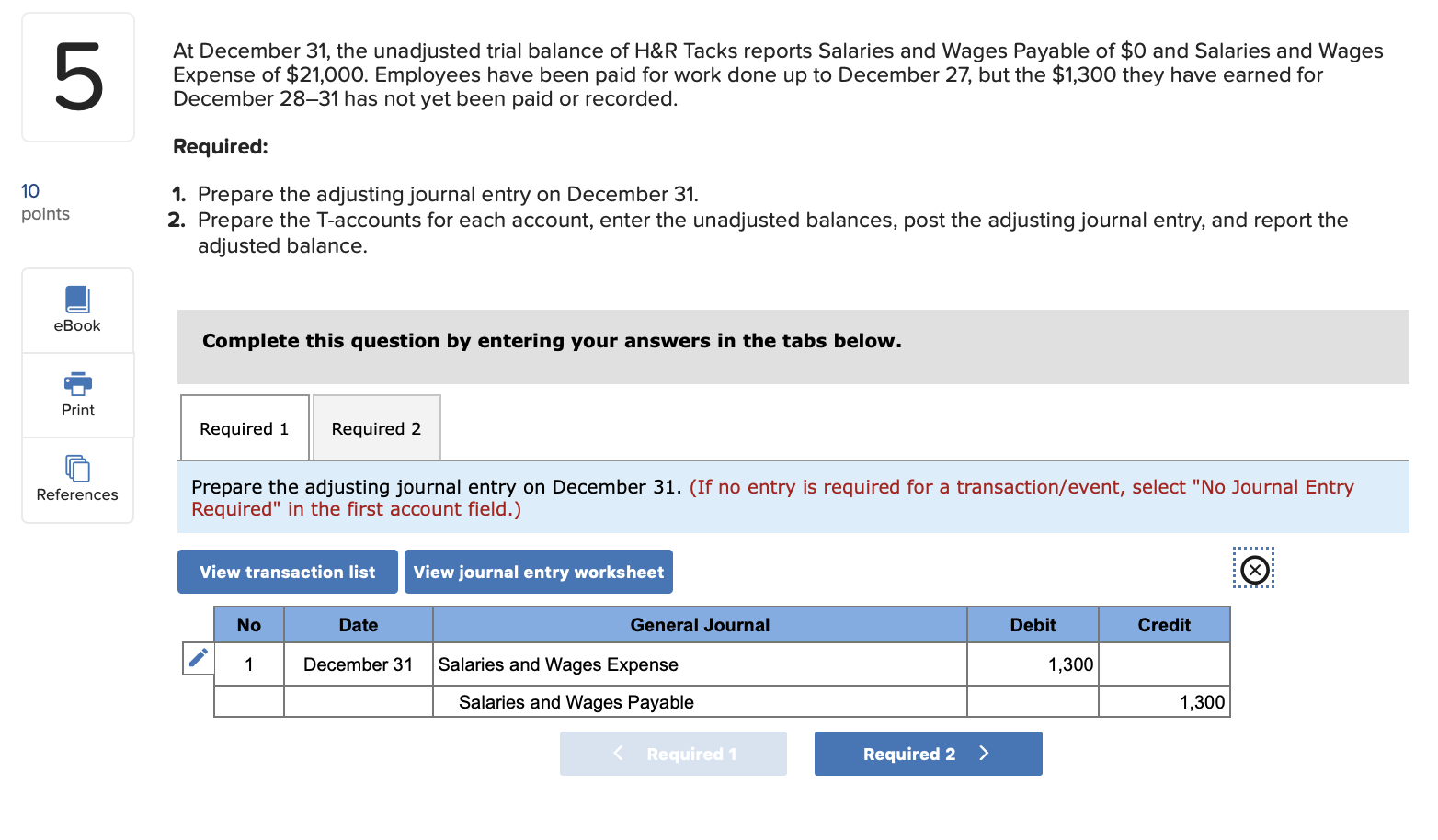

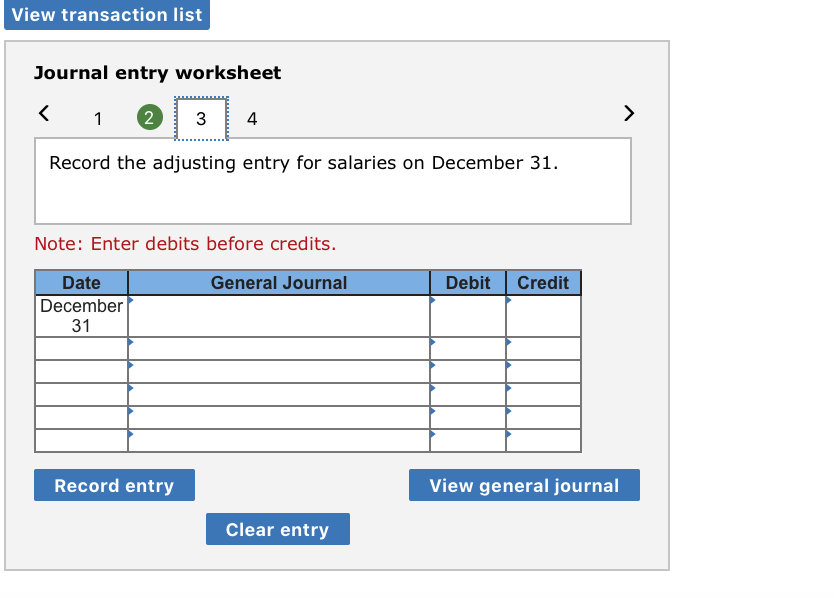

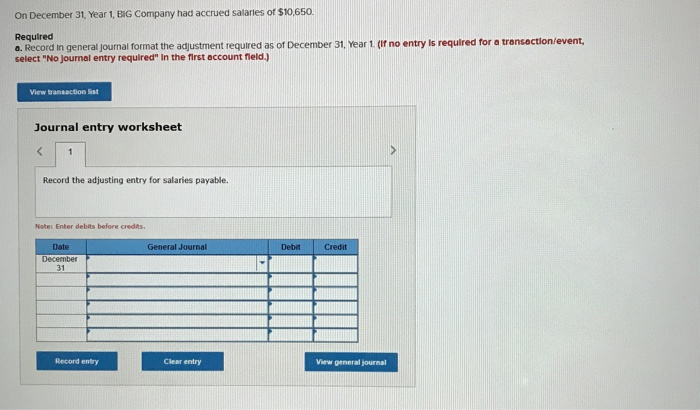

Record the Adjusting Entry for Salaries on December 31.

A broad principle that requires identifying the activities of a business with specific time periods such as. Which of the following entries would be prepared to record the next payment of salaries on January 5 2021 in the amount of 3000.

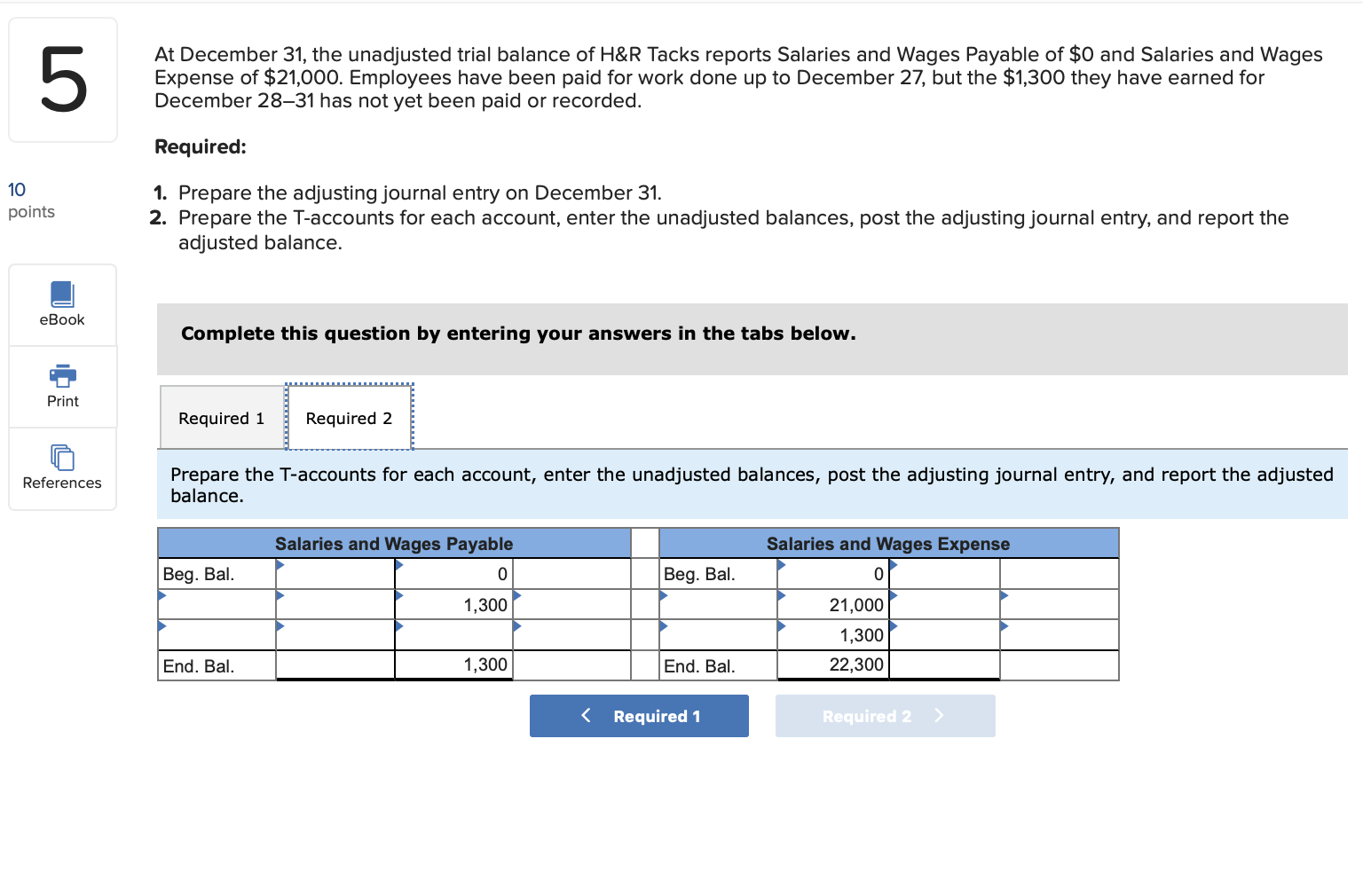

Solved At December 31 The Unadjusted Trial Balance Of H R Chegg Com

Salaries expense and Cash for 750.

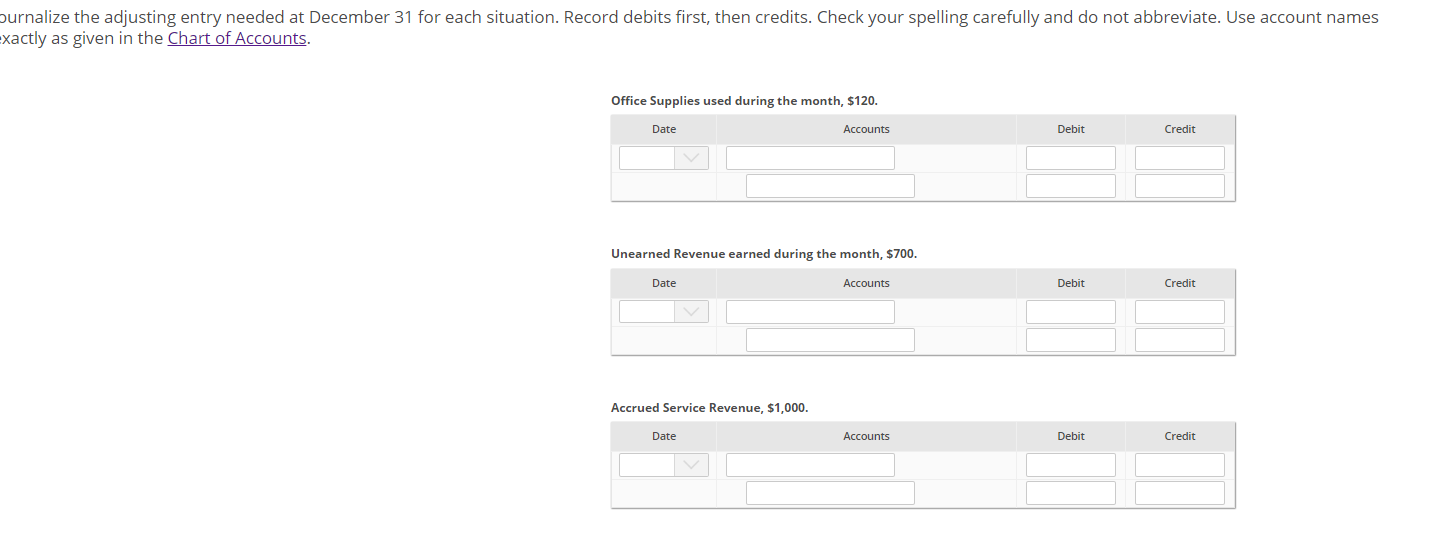

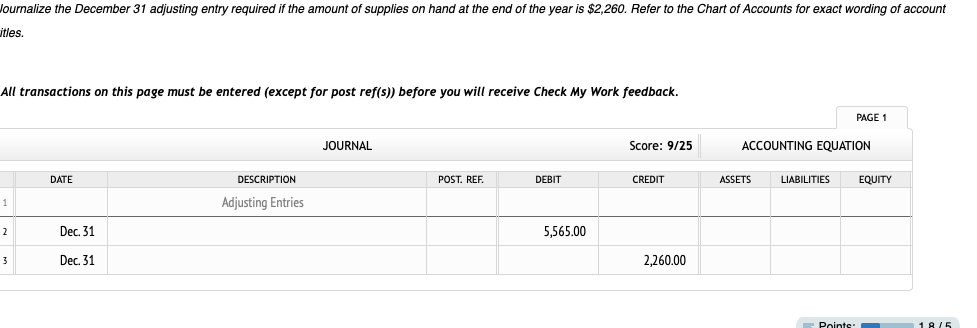

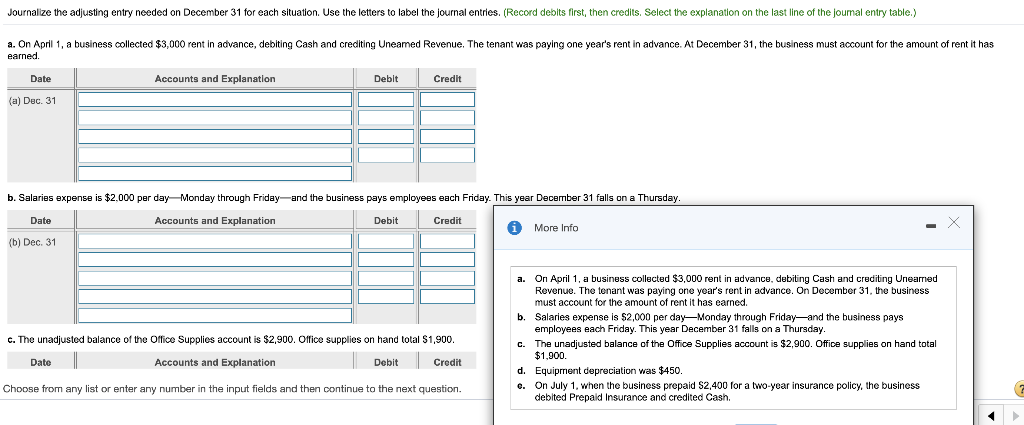

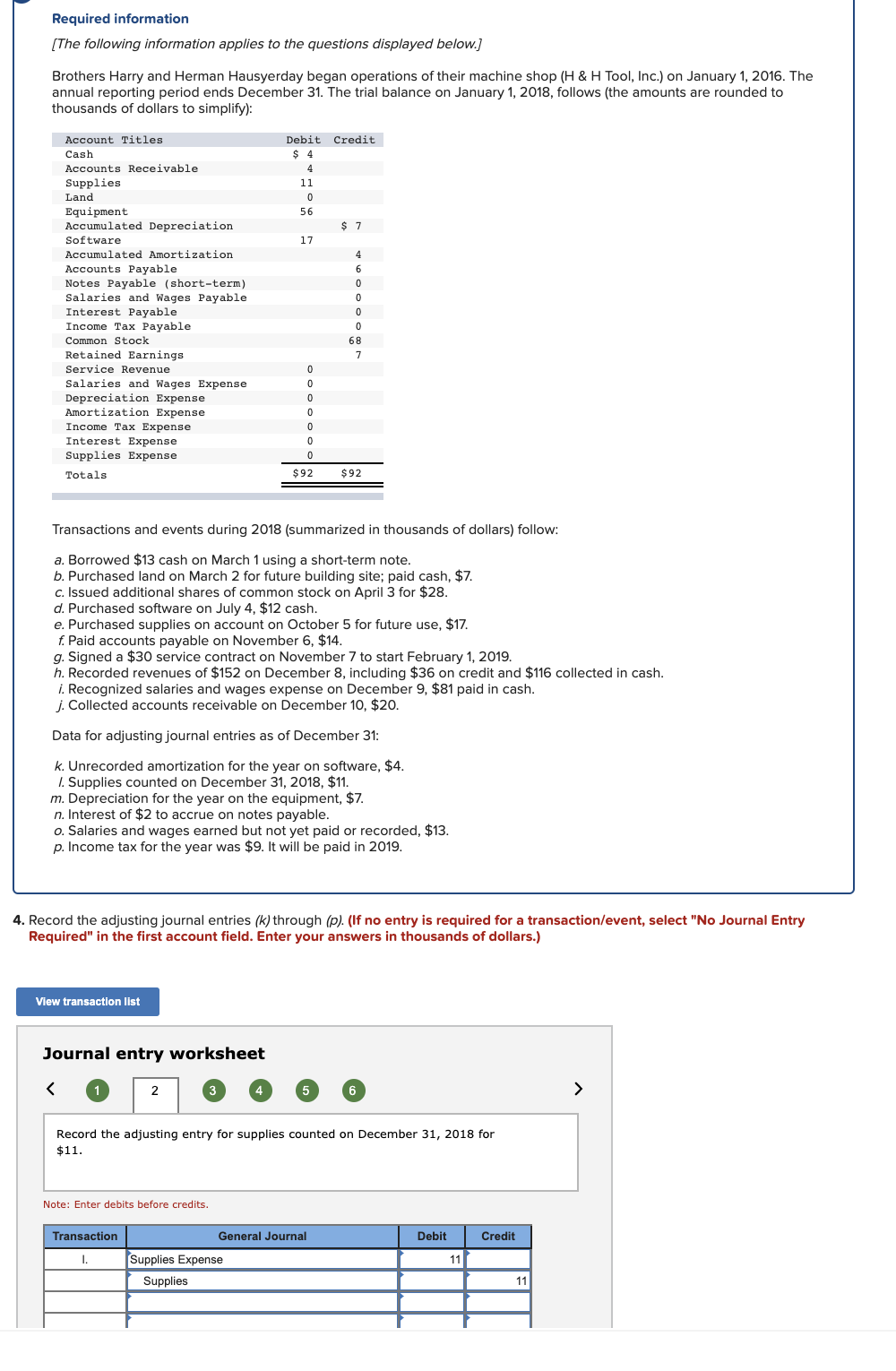

. Give the adjusting entries needed as of December 31 the last day of the current year. A The balance of the supplies account is a debit of P 14125. 4 Record the adjusting entry for supplies on December 31.

A debit to Interest Receivable for 100 and a credit to Interest Income for 100. What account debited and credited. The adjusting entry on December 31 to record the interest earned on the note is.

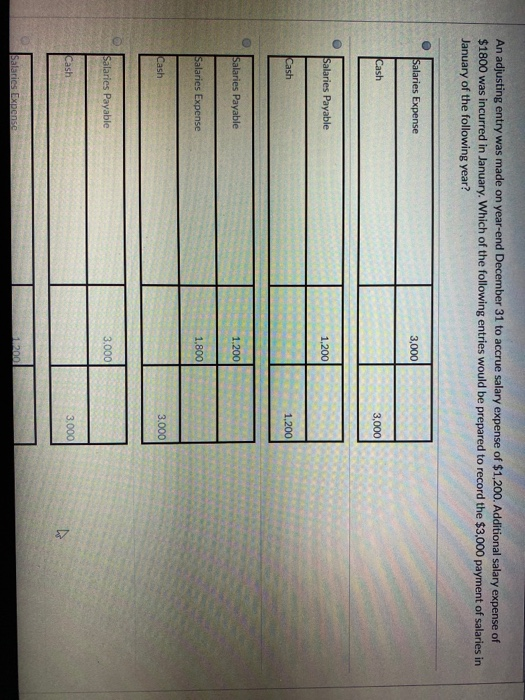

An adjusting entry was made on year-end December 31 to accrue salary expense of 1200. The inventory of supplies on December 31 amounts to P 4220. 3 Record the adjusting entry for salaries on December 31.

Prepare the journal entry on January 3 to record payment assuming the adjusting and reversing entries were made on December 31 and January 1. In other words it is to settle the salaries payable that the company owes its employees for work they have done in December 2019. Prepare an adjusting entry to record accrued salaries a reversing entry on January 1 2022 and an entry to record the payment of salaries on January 7 2022.

Silicon Chip Companys fiscal year-end is December 31. Prepare the journal entry on January 3 to record payment assuming the adjusting and reversing entries were made on December 31 and January 1a. At December 31 employees had earned 13600 of unpaid and unrecorded salaries.

December 28 and 29 are weekend days and employees do not work those days. B prepare the journal entry to record the payment of salaries on January 4 2015. 120012 1 100.

Castillo the sole shareholder of Castillo Services 6200 in dividends during the current year. 1 Record the adjusting entry for rent on December 31. E The factory overhead account has a debit balance of 187600 and a credit balance of 189500 after recording adjustments a through d.

Principal and interest at 8 on the note are due in one year. Credit Salaries Payable 8200. Credit salaries payable 2000.

A debit salaries expense 2000. Debit Salary Expense 9500. The correct adjusting entry for accrued and unpaid employee salaries of 9500 on December 31 is.

Records adjusting entries at its december 31 year end. I need a Journal entry worksheet for numbers 1 2 3 and 4. Supplies Expense 9905 Supplies 9905 To record supplies used.

Show your computations after each entry. Salaries Payable 3000 Cash 3000 C. If salaries are 900 per week.

Credit Salaries Payable 9500 Castillo Services paid K. The next payday is January 3 at which time 30000 will be paid. Assuming the company does not prepare reversing entries which of the following entries would be prepared to record the 3000 payment of salaries in January of the following year.

Debit Salary Expense 8200. The Prepaid Insurance account shows a debit balance of 2340 representing the cost of a two-year fire insurance policy that was purchased on October 1 of the current. December 31 of year 1 is a monday and all 20 employees worked that day.

This journal entry is to eliminate the 15000 of liabilities that the company ABC has recorded in the December 31 adjusting entry. Prepare the january 1 journal entry to reverse the effect of the december 31 salary expense accrual. At the end of 2021 it owed employees 25000 in salaries that will be paid on January 7 2022.

10000 012 1200. 1 on October 1 28000 was paid for a one-year fire insurance policy. Any hours worked.

Cash and Salaries expense for 750. At December 31 employees had earned 12000 of unpaid and unrecorded salaries. An adjusting entry was made on December 31 2020 to accrue salaries expense of 1200.

A company has a fiscal year-end of December 31. Show transcribed image text. At december 31 employees had earned 12000 of unpaid and unrecorded salaries.

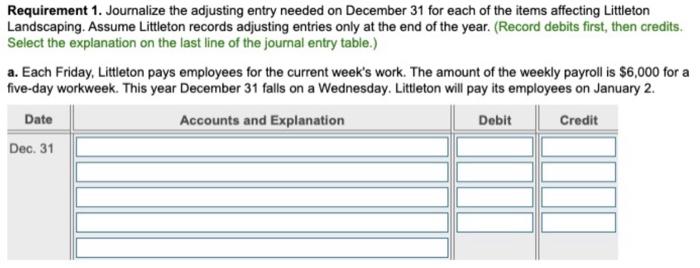

Payroll is the most common expense that will need an adjusting entry at the end of the month particularly if you pay your employees bi-weekly. Salaries Expense and Salaries Payable for 750. Flagg records adjusting entries at its December 31 year-end.

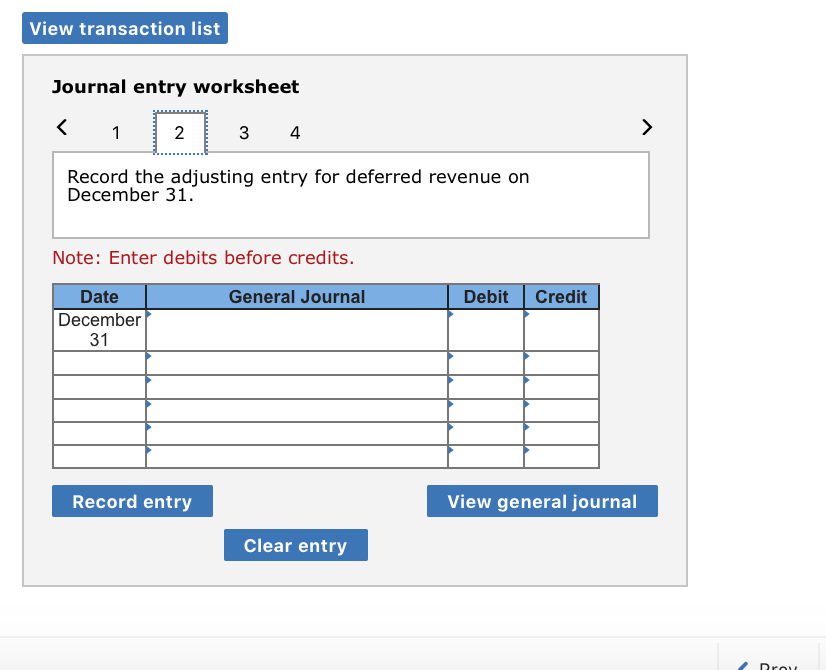

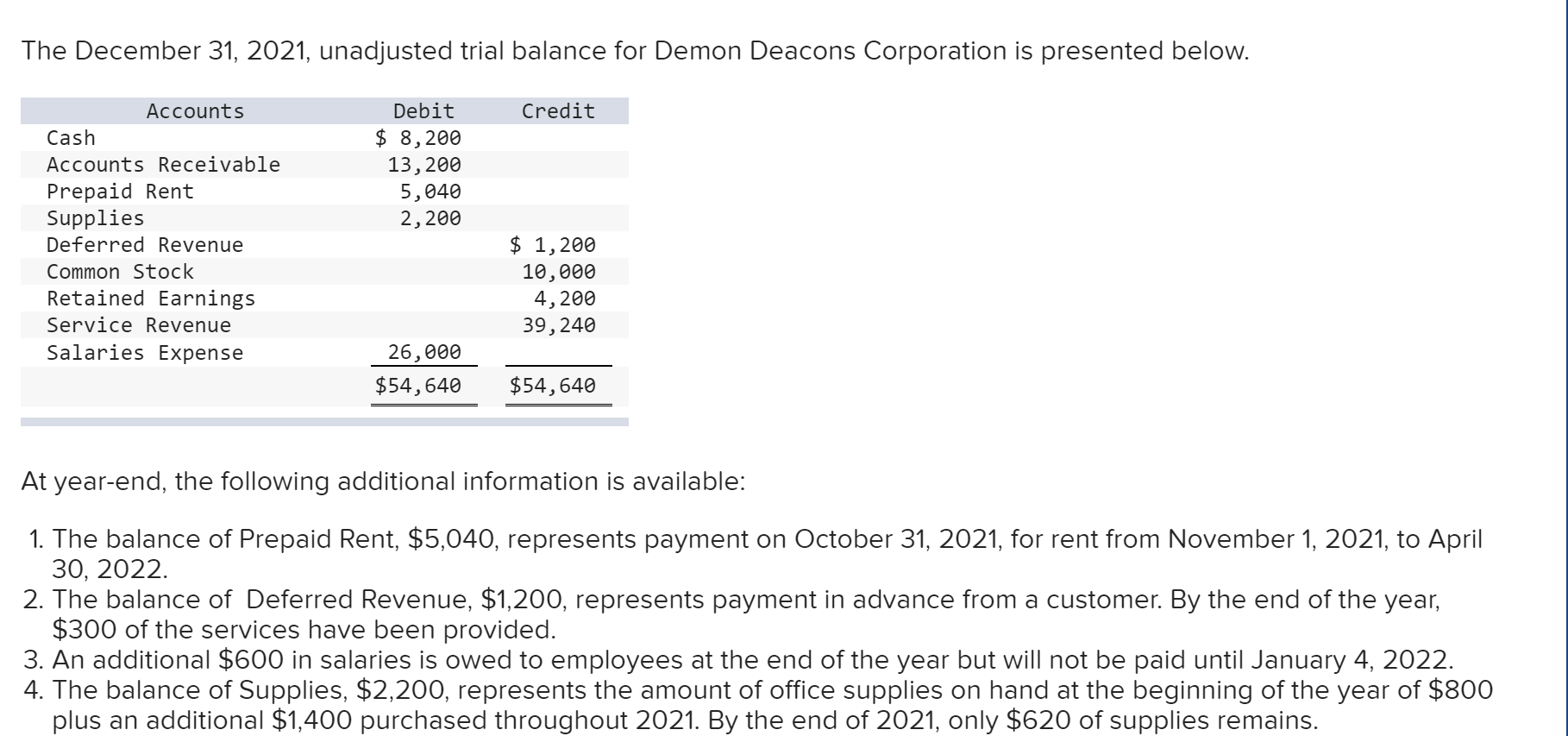

2 Record the adjusting entry for deferred revenue on December 31. Prepare the December 31 adjusting journal entries for Evanoff Company. The next payday is January 3 at which time 34000 will be paid.

For a five-day workweek 900 5 days daily salaries are 180. On December 1 2019 a firm accepted a 6-month 12 percent note for 10000 from a customer. Salaries Expense and Revenues for 750.

We need to account for 2 days December 30 and 31. Record the December 31 adjusting entries for the following transactions and events in general journal form. We need to do an adjusting entry to record the salary earned by employees from December 28 December 31 of this year.

2 on June 30 the company advanced its chief financial officer 26000. Data are as follows. Flagg records adjusting entries at its December 31 year-end.

A prepare the required adjusting journal entry to record accrues salaries on december 31 2014. The next payday is january 3 at which time 30000 will be paid. Salaries Expense 3000 Cash 3000 B.

Show the December 31 adjusting entry to record 750 of earned but unpaid salaries of employees at the end of the current accounting period. The correct adjusting entry for accrued and unpaid employee salaries of 8200 on December 31. Salaries Payable 1200 Cash 1200 3-46.

Assume that December 31 is the end of the annual accounting period. And 3 equipment costing 76000 was purchased at the beginning of the year for cash.

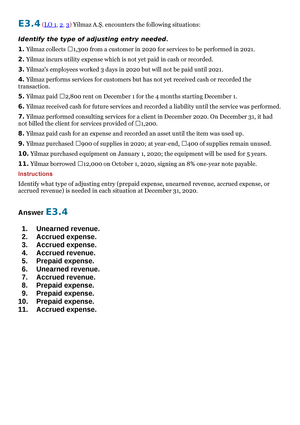

Chapter 3 E3 Lo 1 2 3 Yilmaz A S Encounters The Following Situations Identify The Type Studocu

Problem 3 05 The Accounts Listed Below Appeared In The December 31 Trial Balance Of The Concord Homeworklib

Final Review Jawaban Intermediate Pdf Debits And Credits Income Statement

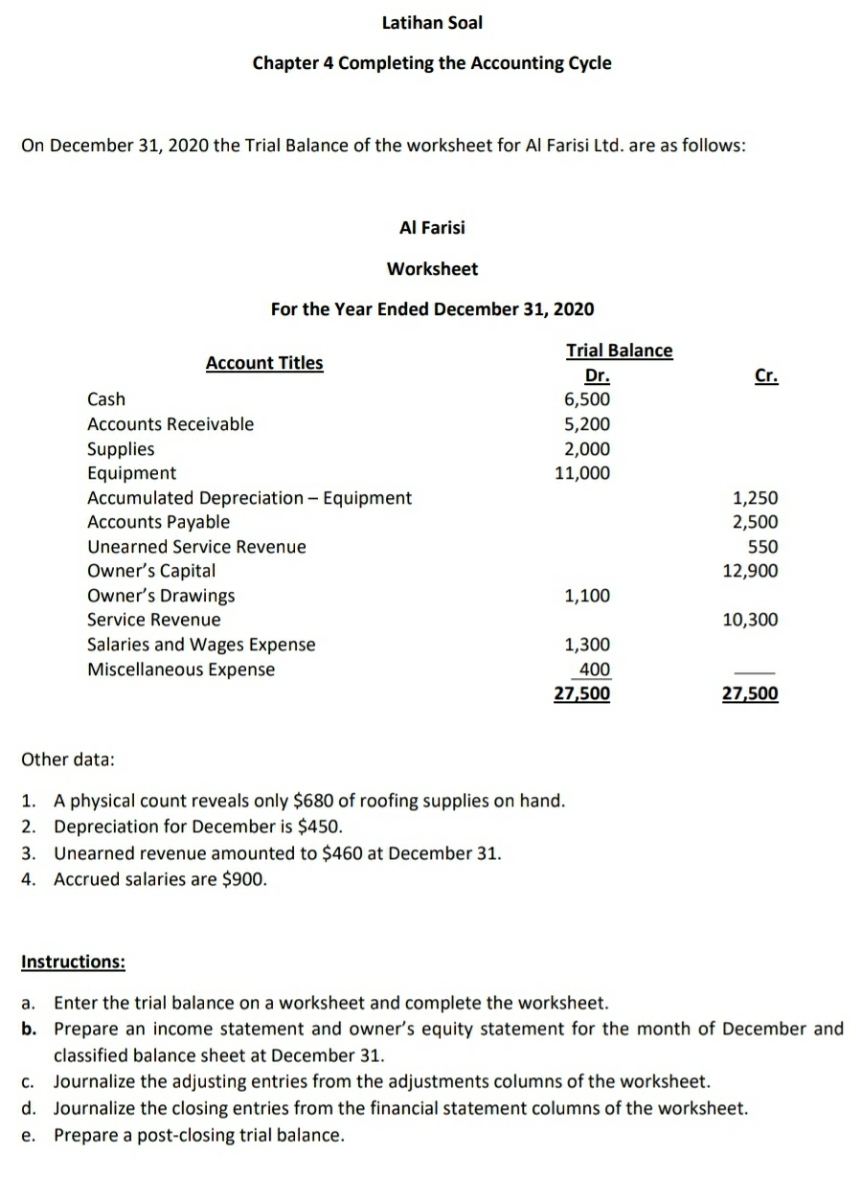

Answered Latihan Soal Chapter 4 Completing The Bartleby

Acg2021 Ch 4 Assignment Flashcards Quizlet

Ch04 Kieso Intermediate Accounting Solution Manual

Solved View Transaction List Journal Entry Worksheet 2 1 3 Chegg Com

Solved On December 31 Year 1 Big Company Had Accrued Chegg Com

Solved Journalize The Adjusting Entry Needed At December 31 Chegg Com

Solved Journalize The December 31 Adjusting Entry Required Chegg Com

Solved View Transaction List Journal Entry Worksheet 2 1 3 Chegg Com

Solved At December 31 The Unadjusted Trial Balance Of H R Chegg Com

Solved Perform Journal Entries For The Following Record Chegg Com

Solved Requirement 1 Journalize The Adjusting Entry Needed Chegg Com

Solved Journalize The Adjusting Entry Needed On December 31 Chegg Com

Solved An Adjusting Entry Was Made On Year End December 31 Chegg Com

Solved Record Adjusting Journal Entries For Each Of The Chegg Com

Solved Journalize The Adjusting Entry Needed At December 31 Chegg Com

Solved Record The Adjusting Entry For Supplies Counted Chegg Com

Comments

Post a Comment